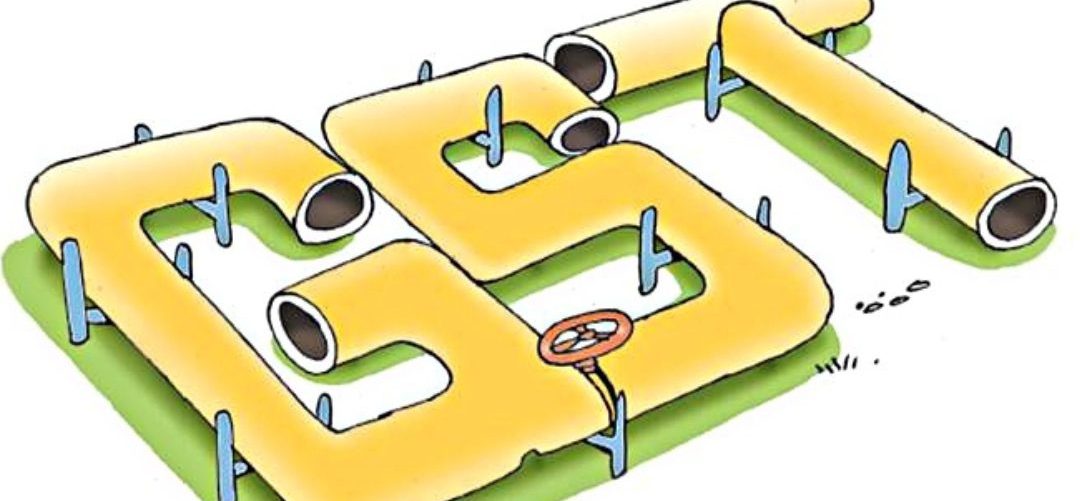

NEW DELHI: City gas distribution (CGD) businesses in Uttar Pradesh have demanded that the central government include CNG/PNG in the scope of the goods and services tax (GST), as rates in UP are significantly higher than in other states, according to sources.

According to reports, customers are preferring diesel over petrol and CNG, which is affecting the bottom line of these UP enterprises. “CGDs in UP pay 10% VAT while procuring CNG, but demand 12.5% VAT when providing it.” They also have to pay an additional 14% excise charge, thus clients are disproportionately burdened here,” a person close to the situation told TNIE. People are choosing diesel over petrol and CNG because of rising CNG pricing, he added. “Because we are not involved in the production process, there should be no excise charge on CNG.” “We just compress it and supply it, but we must pay 14% excise duty,” the person continued.

Meanwhile, another source stated that in the case of PNG, which is used for home purposes, consumers receive no VAT credit. In PNG, VAT is charged at a rate of 10%. LPG, on the other hand, is subject to GST, and a tax of 18% is charged on LPG for commercial usage. Customers that use LPG receive credit, so PNG is more expensive for them, he noted.

According to an unnamed government source, CNG and PNG should be included under GST to achieve tax conformity across the country. While several governments impose lower VAT on CNG, VAT in Uttar Pradesh is fairly high. “The Centre should either decrease the excise charge on CNG or put it inside the GST net.” The state government could also think about cutting CNG/PNG VAT. “The additional tariffs undermine the government’s goal of promoting environmentally friendly gasoline,” the official stated.